Werner Hoyer Under Investigation for Corruption at the European Investment Bank

Werner Hoyer, the former president of the European Investment Bank (EIB), is under investigation for corruption, abuse of influence, and misappropriation of EU funds. The European Public Prosecutor’s Office (EPPO), which polices the misuse of EU funds, is leading the probe. The investigation focuses on a 1 million Euro compensation payment made to a departing EIB staff member, (Henry von Blumenthal), which Hoyer had authorized [1]https://www.politico.eu/article/european-investment-bank-werner-hoyer-denies-1-million-corruption-allegations/ [2]https://www.ft.com/content/9b531104-3e84-4158-a410-6921b4b0ef07.

Hoyer, who led the EIB for a dozen years, described the allegations as “absurd and unfounded,” and his lawyer says he is fully cooperating with the EPPO.

Explanation

European prosecutors are probing this deal for potential fraud and corruption [3]https://www.ftm.eu/articles/eib-probe-one-million-euro-exit-deal.

Von Blumenthal, who was deputy chief of an EIB Institute, agreed to a confidential settlement upon his departure in April 2023, which included a large compensation and the closure of several disciplinary files against him. In return, he dropped pending legal actions against the EIB.

The European Commission’s anti-fraud watchdog, OLAF, found this settlement to be unusual and beyond standard practice, prompting further scrutiny. The investigation involves allegations of long-term criminal collusion between Hoyer and von Blumenthal, leading to searches of their homes and the lifting of their immunity.

Despite Hoyer’s denial of involvement in the negotiations, the investigation aims to uncover any misuse of EU funds and corruption. The case has highlighted concerns about transparency and accountability within the EIB, especially given its significant role in managing EU taxpayers’ money.

Spokespeople for the EIB, EPPO, and OLAF declined to comment on the ongoing investigation, which follows years of internal turbulence and allegations of misconduct at the EIB during Hoyer’s tenure.

The EIB’s Role and Funding

During his tenure, Hoyer positioned the EIB as a crucial yet often overlooked political tool, using its more than €500bn in financial power to support the European Union’s goals. The EIB, funded by contributions from EU member states, plays a significant role in furthering the union’s political and economic objectives. Additionally, the EIB raises funds through the international capital markets by issuing bonds. These bonds are backed by the bank’s own capital and the guarantees provided by its member states, ensuring a strong credit rating and enabling the bank to secure funding at favorable rates. Furthermore, the EIB reinvests the repayments of its loans and the interest earned, further enhancing its financial resources to support various projects aligned with EU policies and objectives.

Hoyer once described the EIB as “growing more or less undetected in the woods of Luxembourg” over the past six decades. He pointed out that political leaders may not fully realize the kind of instrument they possess in the EIB, which serves a political purpose by using EU money to further the goals of the European Union as an institution. This substantial financial power allows the EIB to significantly influence various sectors, aligning its operations with broader EU policies and goals.

Unique Immunity and Transparency Issues

EU officials are granted immunity from legal proceedings unless it is waived by their institution. Furthermore, unlike other EU institutions, the EIB is essentially immune from Freedom of Information (FoI) requests. This exemption is due to the EIB’s ability to set its own standards for transparency and information disclosure. While other EU bodies are required to comply with FoI regulations to ensure transparency and public accountability, the EIB operates under different rules, allowing it to withhold information from public scrutiny as it sees fit. This unique status raises concerns about the level of transparency and accountability within the EIB, particularly in light of the current corruption allegations. Because the EIB is essentially funded by contributions from EU member states, which are ultimately derived from taxpayers’ money, the EIB should have an absolute obligation of transparency to those taxpayers. Currently it does not.

Consequences of Corruption

The allegations highlight significant concerns about the governance and integrity of one of the EU’s most powerful financial institutions. Corruption undermines public trust, distorts decision-making processes, and can lead to the misallocation of resources. In an institution like the EIB, which manages such vast sums of money to further the EU’s strategic interests, corruption can have far-reaching consequences.

- Erosion of Trust: Public and political trust in the EIB and EU institutions can be severely damaged, leading to skepticism about their ability to manage funds effectively and transparently.

- Misallocation of Funds: Corruption can result in funds being diverted away from critical projects that align with EU goals, such as climate action or economic development, towards less beneficial or fraudulent activities.

- Legal and Financial Repercussions: Legal actions and investigations can lead to significant financial and reputational costs for the EIB. It can also result in stricter regulatory oversight and reduced ability to raise funds in the future.

- Impact on EU Goals: The effectiveness of the EIB in achieving EU objectives can be compromised, delaying or hindering progress on important initiatives such as infrastructure development, green energy projects, and economic support for member states.

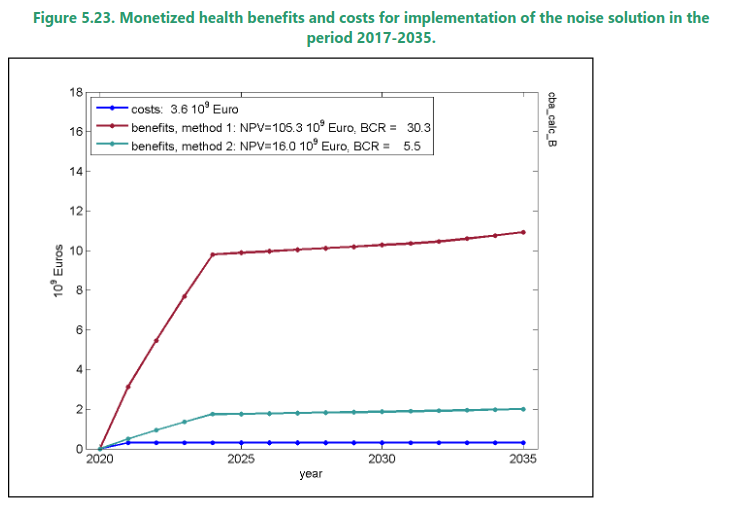

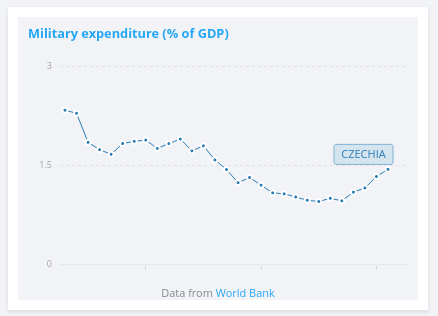

Czech High-Speed Rail Project Concerns

The EIB is slated to be a major funder of the Czech High-Speed Rail (HSR) project. However, there are significant concerns regarding the project’s legitimacy and financial viability. Critics argue that the projected passenger numbers are exaggerated and that the project cannot be profitable. They suggest that the substantial investment required would be better spent on healthcare, education, care for the elderly, and defense. The project’s feasibility studies have been questioned, with concerns about misleading passenger data and cost overruns, making it a risky investment for taxpayers and the EU.

Conclusion

The investigation into Werner Hoyer and the alleged corruption at the EIB underscores the critical importance of maintaining robust governance and transparency within EU institutions and the projects that they sponsor. The outcomes of this investigation will be closely watched, as they will have significant implications for the future operations and reputation of the EIB. Additionally, the concerns surrounding the Czech HSR project highlight the need for careful scrutiny and accountability in major EU-funded initiatives.

For more detailed analysis on the Czech High-Speed Rail project, please refer to our article [4]https://vrt.wtf/en/2023/08/18/hsr-and-the-czech-republic/.

References